Capital structure is a complex area of financial decision making due to the relationship between the firm's financing sources, the firm's risk/return profile, and the firm’s value

External Assessment of Capital Structure

Debt Ratios can be used to measure the firm's degree of financial leverage

Measurements of indebtedness

Measurements of ability to service debt

The more risk a firm is willing to take, the greater will be its financial leverage

A firm should theoretically maintain a level of financial leverage consistent with the capital structure that maximizes shareholder wealth

There are significant differences in typical degrees of financial leverage between industries

Capital structure patterns among industries tend to be quite similar around the world

Capital Structure Theory

How a chosen financing mix affects the firm's value has been a topic of considerable study

Modigliani and Miller (hereafter "M & M") demonstrated algebraically that, assuming perfect markets, capital structure has no effect on the firm's value

The major costs of debt financing include

The probability of bankruptcy due to an inability to meet obligations depends on:

Business Risk

Financial Risk

Agency Costs Imposed by Lenders

Asymmetric Information

Asymmetric Information

If a firm's managers feel that the firm's stock is undervalued and there is an available investment that they feel will increase the value of the firm, the managers will use debt financing to fund it

If a firm's managers feel that the firm's stock is overvalued, however, they will use a stock issue to finance the investment

Debt is generally seen as a positive signal

Equity is generally seen as a negative signal

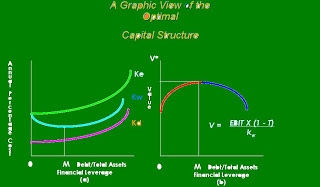

Cost Functions

kd = After-tax cost of debt

ke = Cost of equity

kw = Weighted average cost of capital

The cost function graphs illustrate the behavior of the costs of debt and equity as their use increases by the firm. Their combined effect on the weighted average cost of capital is also shown.

A Graphic View of the Optimal Capital Structure

No comments:

Post a Comment